The Rise of Neobanks: Challenging Traditional Banking Models

Discover how neobanks are redefining the banking landscape with digital innovation.Remember that frustrating afternoon when you had to rush to your local bank branch before closing time, only to find a long queue and a less-than-enthusiastic teller? Well, those days might soon be behind us. Enter the world of neobanks, the digital disruptors that are turning traditional banking on its head.

What Are Neobanks?

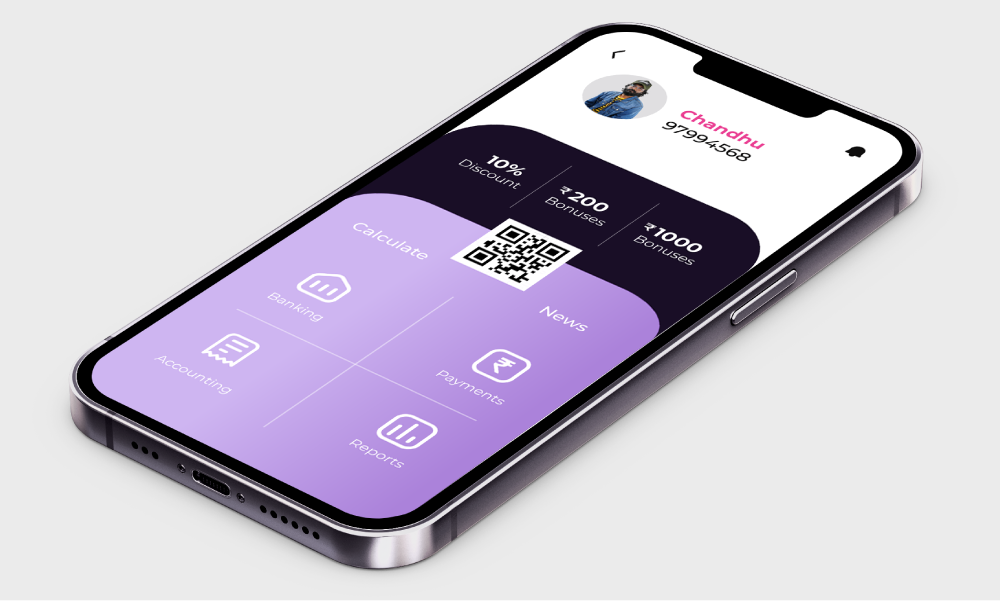

Neobanks are digital-only financial institutions that operate without physical branches[1]. They leverage cutting-edge technology to offer banking services entirely through mobile apps and online platforms[1]. Unlike traditional banks with their brick-and-mortar locations and legacy systems, neobanks are built from the ground up with a focus on user experience and technological innovation.

The Neobank Advantage

Why are neobanks gaining so much traction? It's simple: they're addressing pain points that have long plagued traditional banking.

Lower Fees, Better Rates

Neobanks often offer lower fees and better interest rates compared to their traditional counterparts[3]. Without the overhead costs of maintaining physical branches, they can pass these savings on to customers.

User-Friendly Interfaces

Gone are the days of clunky online banking portals. Neobanks pride themselves on sleek, intuitive mobile apps that make managing your money as easy as scrolling through social media[4].

Innovative Features

From real-time spending analytics to automated savings tools, neobanks are constantly rolling out features that make personal finance management a breeze[4].

Neobanks in Action

Let's take a closer look at some of the major players in the neobank space:

Chime

This U.S.-based neobank has seen explosive growth, boasting over 21 million users as of today[2]. Chime's success lies in its user-friendly approach and features like early direct deposit and no-fee overdrafts.

N26

Originally from Germany, N26 has expanded across Europe and into the U.S., offering a sleek interface and innovative features like "Spaces" for easy budget management.

Revolut

Known for its multi-currency accounts and cryptocurrency trading features, Revolut has become a favorite among international travelers and tech-savvy users.

Reshaping the Banking Landscape

The rise of neobanks isn't just changing how we bank; it's fundamentally altering the entire financial services industry[4].

Pressure to Innovate

Traditional banks are feeling the heat. They're being forced to up their digital game, with many launching their own digital-only offshoots or partnering with fintech companies[3].

Changing Customer Expectations

As consumers get used to the convenience and user-friendly nature of neobanks, they're demanding more from all financial institutions. Banking at the speed of light is becoming the new norm.

Financial Inclusion

Neobanks are also playing a crucial role in bringing banking services to underserved populations. In countries like Indonesia and the Philippines, neobanks are using mobile technology to provide essential services to those previously excluded from traditional banking[1].

Challenges on the Horizon

It's not all smooth sailing for neobanks, though. They face their own set of challenges:

Regulatory Hurdles

Navigating the complex world of financial regulations can be tricky for these digital newcomers.

Building Trust

Without physical branches, neobanks need to work harder to establish credibility and trust with consumers.

Profitability

Many neobanks are still working towards sustainable profitability models.

The Future of Banking

As we look ahead, it's clear that the banking landscape will continue to evolve. We're likely to see a hybrid model emerge, where traditional banks and neobanks coexist, each leveraging their unique strengths.

Imagine a world where your banking experience is as personalized and seamless as your favorite streaming service. Where your money works for you 24/7, and financial decisions are supported by AI-powered insights. That's the promise of the neobank revolution.

In conclusion, neobanks are more than just a trend – they're reshaping our relationship with money. As they continue to innovate and expand, one thing is certain: the future of banking is digital, user-centric, and exciting. The question is, are you ready to make the switch?

References

- https://kadence.com/en-us/the-rise-of-neobanks-and-the-impact-on-traditional-banking/

- https://lancersglobal.com/insights/digital-transformation/revolutionising-finance-how-neobanks-are-transforming-traditional-banking

- https://www.linkedin.com/pulse/rise-neobanks-impact-traditional-banking-nandini-rathore

- https://fintechly.com/banking/the-rise-of-neobanks-disrupting-the-traditional-banking-sector-with-fintech-innovation/

Behavioral Economics in Personal Finance: Understanding Your Money Mindset

Comments

Neobanks are truly shaking up the banking industry. The convenience and lower fees they offer are appealing, especially for tech-savvy users. It’ll be interesting to see how traditional banks respond to this growing competition.

Leave a Comment