Debt-Free Dreams: Budgeting Tips for Young Adults

Smart budgeting tips to turn financial stress into debt-free success.Picture this: You're fresh out of college, starting your first "real" job, and finally feeling like an adult. Then the bills start rolling in - student loans, rent, car payments, and suddenly that grown-up feeling turns into a pit in your stomach. Sound familiar? Don't worry, you're not alone. As a financial advisor who's worked with countless young adults, I've seen this scenario play out more times than I can count. But here's the good news: with some smart budgeting, you can turn those financial fears into debt-free dreams.

Understanding Your Financial Situation

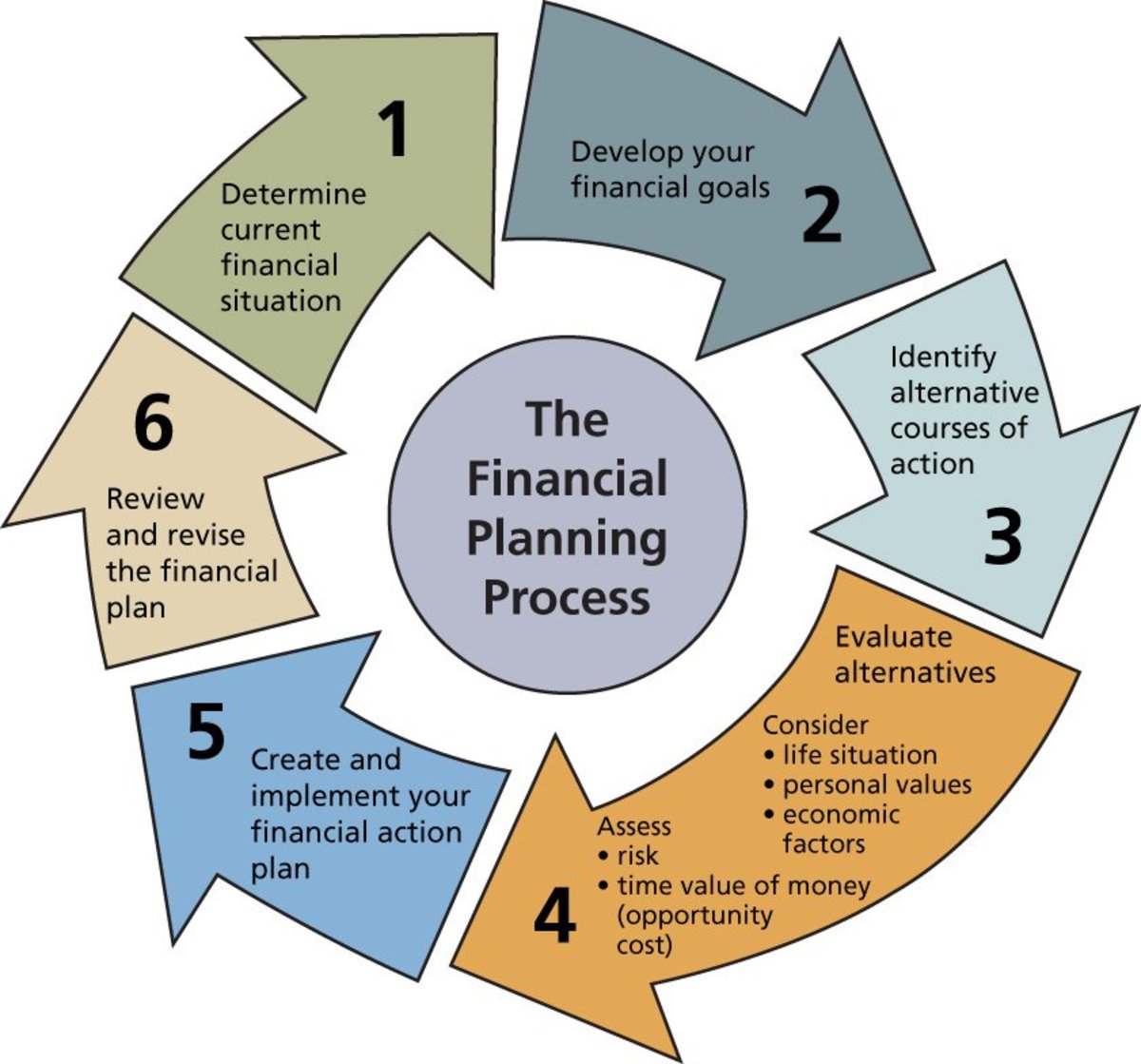

The first step to financial freedom is knowing exactly where you stand. It's like checking the map before a road trip - you need to know your starting point. Sit down with all your financial statements and make a list of your income, expenses, and debts. Don't shy away from the numbers, even if they're scary. Trust me, I've seen it all, and knowledge is power when it comes to your money.

Setting Financial Goals

Now that you know where you are, it's time to decide where you want to go. In my experience, the most successful budgeters are those who set SMART goals - Specific, Measurable, Achievable, Relevant, and Time-bound. Maybe you want to pay off your student loans in 5 years, or save for a down payment on a house. Whatever it is, write it down and make it concrete.

Creating a Realistic Budget

Here's where the rubber meets the road. Creating a budget is like meal prepping for your wallet - it takes some effort upfront, but it makes your life so much easier in the long run. I'm a fan of the 50/30/20 rule: 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment. But remember, this is a guideline, not a hard and fast rule. Your budget should fit your life, not the other way around.

Tracking Expenses

You'd be amazed at how many lattes or late-night Amazon purchases can slip through the cracks if you're not paying attention. I always tell my clients to track their expenses for a month - every single penny. It can be eye-opening (and sometimes a little embarrassing), but it's the best way to see where your money is really going.

Cutting Unnecessary Expenses

Now, I'm not going to tell you to give up everything you love. Life's too short for that. But I bet there are some expenses you could cut without feeling the pinch. Maybe it's that gym membership you never use, or switching to a cheaper phone plan. Small changes can add up to big savings.

Building an Emergency Fund

If there's one thing I've learned in my years as a financial advisor, it's that life loves to throw curveballs. An emergency fund is your financial safety net. Start small - even $500 can make a difference - and work your way up to 3-6 months of expenses.

Tackling Debt

Debt can feel like a monster under the bed, but I promise it's beatable. I've seen clients crush massive debts with the right strategy. The snowball method (paying off smallest debts first) can be great for motivation, while the avalanche method (tackling highest interest rates first) can save you more in the long run. Choose the one that works best for you.

Increasing Income

Sometimes, the best way to balance your budget is to boost your income. In today's gig economy, there are countless ways to make extra cash. I had a client who turned her knitting hobby into a successful Etsy shop. Get creative!

Investing for the Future

I get it - when you're struggling to make ends meet, investing can seem like a far-off dream. But even small amounts can grow significantly over time, thanks to the magic of compound interest. It's like planting a money tree - the earlier you start, the bigger it grows.

Avoiding Common Financial Pitfalls

In my years of advising, I've seen some common mistakes young adults make. Overusing credit cards, ignoring their credit score, or falling for get-rich-quick schemes are big ones. Remember, if it sounds too good to be true, it probably is.

Staying Motivated

Budgeting is a marathon, not a sprint. There will be times when you want to throw in the towel and buy everything in your Amazon cart. When that happens, remind yourself of your goals. Celebrate your wins, no matter how small. And don't beat yourself up over slip-ups - we all have them.

Conclusion

Here's the thing: budgeting isn't about depriving yourself. It's about taking control of your money so you can live the life you want. I've seen countless young adults go from financial stress to debt-free success. With some planning, discipline, and maybe a few less lattes, you can do it too. Your future self will thank you.

Remember, every financial journey starts with a single step. So why not start today? Your debt-free dreams are waiting.

References

- https://www.stash.com/learn/budgeting-for-young-adults/

- https://www.drishticuet.com/blog/detail/financial-literacy-a-guide-for-young-adults

- https://www.ccculv.org/Blog2024Jun%20Budgeting%20Tips%20For%20Young%20Adults

- https://www.incharge.org/financial-literacy/budgeting-saving/tips-for-young-adults/

- https://www.hollyscherer.com/budget/

- https://www.investopedia.com/articles/personal-finance/112015/these-10-habits-will-help-you-reach-financial-freedom.asp

- https://americasaves.org/resource-center/insights/54-ways-to-save-money/

- https://www.bajajamc.com/knowledge-centre/articles/personal-finance-tips-for-young-adults

Comments

No comments yet. Be the first to comment!

Leave a Comment